News

The status quo of the global terminal connector industry

- Categories:News

- Time of issue:2021-08-04 10:37

- Views:

(Summary description)Since 1985, Bishop&Associates has counted 589 mergers and acquisitions in the terminal connector industry. From 1985 to 1999, there were 126 acquisitions. The pace of mergers and acquisitions has accelerated significantly. Since 2000, it has been conducted 463 times. We count on October 1, 2018 as a limit. However, in the first two weeks of October, several acquisitions have already occurred, and by the end of this year, more acquisitions may occur.

The status quo of the global terminal connector industry

(Summary description)Since 1985, Bishop&Associates has counted 589 mergers and acquisitions in the terminal connector industry. From 1985 to 1999, there were 126 acquisitions. The pace of mergers and acquisitions has accelerated significantly. Since 2000, it has been conducted 463 times. We count on October 1, 2018 as a limit. However, in the first two weeks of October, several acquisitions have already occurred, and by the end of this year, more acquisitions may occur.

- Categories:News

- Time of issue:2021-08-04 10:37

- Views:

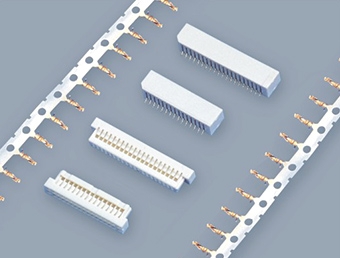

The global terminal connector industry has developed rapidly in recent years, and the industry concentration is gradually increasing. Internationally represented by the three multinational giants TE, Amphenol, and Molex, not only have their market share increased year by year, but at the same time, the same industry and cross-industry mergers and acquisitions have become more rapid. More than a dozen listed companies in the terminal connector industry in China, represented by Luxshare Precision, are also in the process of accelerating the pace of mergers and acquisitions. The rapid integration of resources in China's terminal connector industry is imperative.

Since 1985, Bishop&Associates has counted 589 mergers and acquisitions in the terminal connector industry. From 1985 to 1999, there were 126 acquisitions. The pace of mergers and acquisitions has accelerated significantly. Since 2000, it has been conducted 463 times. We count on October 1, 2018 as a limit. However, in the first two weeks of October, several acquisitions have already occurred, and by the end of this year, more acquisitions may occur.

The three largest terminal connector companies in the world have been very aggressive in acquiring competitors. From 1999 to 2017, Amphenol acquired 49 companies, and in 2018 it acquired three companies. During the same period, Molex acquired 27 and TE acquired 25.

Of particular note is that while acquiring 52 companies, Amphenol also achieved the "best in the industry" financial performance. The company's net income and return on equity have remained at double digits, the highest in the industry.

The following table lists the impact of the acquisition on the terminal connector industry.

The performance of the three major terminal connector companies from 1999 to 2017

In 1999, TE, Amphenol, and Molex had a total of 29.4% of the terminal connector market. By 2017, the market share of the three major companies rose to 35.3%.

From 1999 to 2017, the compound annual growth rate (CAGR) of the Big Three reached 4.8%. The average compound annual growth rate of the terminal connector industry is 3.3%.

Amphenol's aggressive acquisition (49 transactions between 1999 and 2017) resulted in a CAGR of 12.6% in 18 years. Their market share has also increased from 2.5% in 1997 to 11.0% in 2017.

There is no doubt that the acquisition has had a significant impact on the terminal connector industry. For example, many important terminal connector companies have been merged into larger entities. Including Augat, FCI, Robinson Nugent, Cardell and M/A-Com, etc., these companies no longer exist. Other companies such as Teradyne, Litton Industries, Thomas & Betts, TRW and Labina still exist, but they have sold their terminal connector business.

Scan the QR code to read on your phone

Hot News